Book-keeping-style spending plans

Today I’m going to talk about the type of spending plan that most people mean when they talk about a “budget”. That is to say, a list of sources of income and a list of types of expenses and payments to savings/investments with weekly or monthly amounts of each beside them, so you can add up each list and check they balance. Actual income and spending is then tracked against the lists to make sure you’re not going outside your plan.

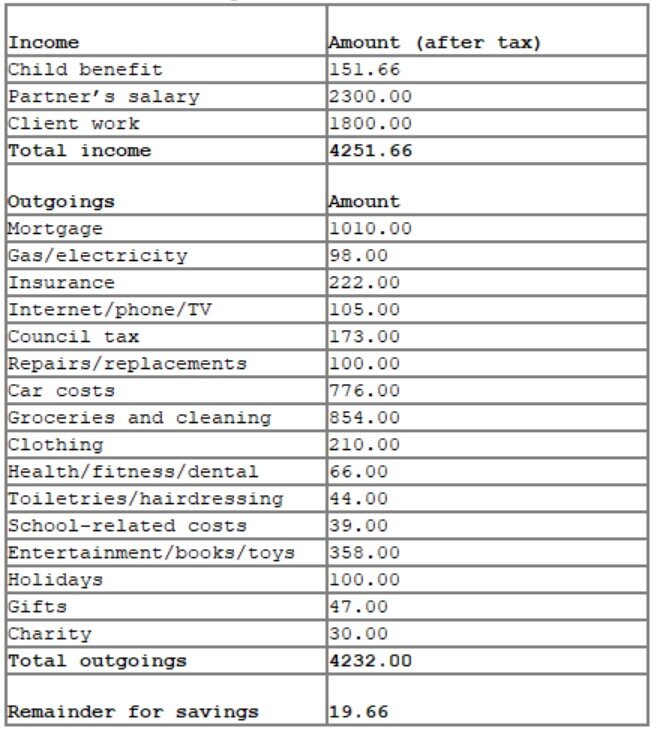

Let me give you an example. This is a plan for two parents on a moderate income with two kids and in a rented three-bedroom house with two cars to run and no pets.

Leaving aside the actual amounts here*, let’s talk about the advantages and disadvantages of this method.

Pros and cons

The pros:

You know exactly, and I mean exactly, what’s going on with your money at any given time.

You can catch any risk of overspending immediately before it happens.

You can spot fraudulent payments and rising costs immediately and do something about it.

The cons:

Time consuming - this is the biggest one, it takes time and effort to set up and then time to maintain.

If your spreadsheet or app goes wrong somehow, then things can get very frustrating.

You need to be consistent with it and build it into your routine.

May need to get into the habit of asking for/keeping receipts or you’ll have unaccounted spends which can quickly pile up.

If you think this method could be for you, here’s how you create a plan this way and make it work.

How to

You can do all the calculations on paper, but it’s easier with a spreadsheet and most spreadsheet programmes come with personal or family budget templates galore. There is also one on Money Saving Expert, StepChange and honestly, practically every money blog out there. You can also make your own. Alex did after we recorded this episode of Squanderlust and you can find out how she got on in this episode. I used to use this template, but I don’t use this method personally, any more.

If you’re going to build your own spreadsheet, you need to know what calculations need to go into it, so let’s talk about that. If you hate maths and will be using a template, you can skip this, but I promise it’s all very easy maths.

Weekly or monthly?

The first thing is that your spending plan needs to be for either weekly or a monthly spending. There isn’t a hybrid method. Weekly makes it easy to track smaller amounts of money and day-to-day spending. Monthly works better for bigger overall amounts, monthly salaries and bills paid by direct debit/standing order.

Our spending, however, usually comes in a mix of weekdays, daily, weekly, monthly and longer time periods. So we need to do some conversions.

To convert to weekly:

= weekday spend x 5

= daily spend x 7

= monthly spend ÷ 4.33 (because there are 52/12= 4.33 weeks in a month, not 4)

= quarterly spend ÷ 13

= annual spend ÷ 52

To convert to monthly:

= weekday spend x 21.66 (because 21.66 = 5 x 4.33)

= daily spend x 30.32 (because 30.32 = 7 x 4.33)

= weekly spend x 4.33

= quarterly spend ÷ 3

= annual spend ÷ 12

I don’t wanna do maths or spreadsheets

That’s fine, there are loads of online calculators that do this for you. Two examples that come to mind straight away are The Money Charity’s Budget Builder and the Money Advice Service Budget Planner. There are lots of great phone apps that do it too, but we’ll leave those for another day. You can also do a different style of spending plan altogether.

Make it accurate

I can’t emphasise this enough, your plan must be based in reality. If you fudge it you won’t be able to stick to it. How do you make it accurate? Look at the actual figures. Use bank statements, receipts, payslips, benefits entitlement letters, bills and so on to work out how much money actually comes into your household and where it goes.

This is often the point where people give up from sheer shock at the real numbers, which can seem very discouraging. They don’t have to be though. They’re your starting point, not your end point.

You can set targets to change the numbers as part of your plan. If you realise you’re spending more than you thought on energy, you can look at ways to cut your electricity bills. If you’re spending way over the odds on your phone tariff, that’s something you can switch up. If your grocery bill is twice what you thought it was, you can research tips on thrifty meals and avoiding food waste.

A note on occasional spends

One thing that wrongfoots people doing this style of spending plan is occasional spends. Birthdays, Christmas and other religious festivals, household repairs, replacement gadgets, school uniforms and trips, new tires and the like all need to be in your plan or you will never have the money for them and you’ll always feel like you “can’t budget because something always happens”. If they’re in the plan, you can put money aside for them each month. Build up a pot of cash in an instant access savings account ready to cover them. Work out what you expect to spend on each of these types of costs every year and treat like an annual cost as above.

Balance your budget

This is the moment of truth, when you add up all your expenses and take that away from the total of your income sources, what do you have left? If there’s money left over, happy days, you can put that towards saving and investing for your future. If not, then at least you can investigate where the issue is and look for fixes. If things are looking very bleak, don’t delay contact a debt adviser. If the idea of that feels uncomfortable, we talked about why it’s good to get advice early on the podcast, including a description of what happens when you go for debt advice, so you know what to expect.

Once you’re happy you’ve got your outgoings below your income and enough going towards your future needs and wants, take a moment to admire your plan. Congratulations on your hard work.

Wait there’s more!

Lots of people get this far and then stop, but I’m afraid this is the beginning not the end. A plan is pointless if you don’t act on it. Now you need to actually track your income and spending against your plan. It’s usually best to do this daily, or at least every other day. Miss this step and the whole ‘making a spreadsheet’ bit was a waste of time. You need to actually make sure you spending no more than you planned and that your allowances for your different categories were appropriate.

Once you start tracking, you might find that your plan was a bit out here and there. It’s pretty common to get it wrong the first time. That’s ok, you can adapt and update it as necessary. As you get better at finding ways to be thrifty, you can start putting more towards paying down borrowing or into savings and investments. Or, if you’ve been being a bit over-frugal, you can re-introduce some fun and creature comforts into your life, safe in the knowledge that you can afford them, because they’re in the plan.

(*this family could probably save loads on some areas and other areas the figures might be unrealistically low)

Would this type of spending plan work for you? What do you think?

To hear more about different ways to plan and track spending, check out my podcast Squanderlust Episode 7 : Budget Pick ‘n’ Mix